s corp tax rate calculator

Incorporate Your S-Corp Today. C-Corp or LLC making 8832.

S Corporation Shareholders And Taxes Nolo

Total first year cost of S-Corp.

. The S Corporation tax calculator lets you choose how much to withdraw from your business each year and how much of it you will take as salary with the. From there it can determine the corresponding sales tax rate by accessing. Lets start significantly lowering your tax bill now.

Article by Kelly Luttrel SOI. Ad Our Easy Step-By-Step Process Takes The Guesswork Out Of Filing Self-Employed Taxes. For example if you have a.

Estimated Local Business tax. So its effective tax rate was 19 3331. Tax rates are assumed for the full calendar year if rates are adjusted mid-year this calendar should still.

Annual state LLC S-Corp registration fees. Forming an S-corporation can help save taxes. Say you earn 150000 in revenue as the owner.

For Tax Year 2003 about 619 percent of all corporations filed a Form 1120S. Partnership Sole Proprietorship LLC. Using the S Corporation Tax Savings Calculator.

Well Search Thousands Of Professionals To Find the One For Your Desired Need. With Social Security at 124 and Medicare at 29 Self-Employment is a major cost of 153 right off the top before theres any income taxes paid. Self-employed business owners pay a 153 percent tax rate on all income under 94200 and a 29 percent rate on all income over that amount.

The S Corp Tax Calculator. This calculator checks the Corporation Tax on the Gross Profit figure you. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses.

S Corporation Subchapter S and S Corp Tax Rate. An S corporation S corp is a tax structure under Subchapter S of the IRS Internal Revenue Service for federal state. Ad We Make It Easy To Incorporate With Step-By-Step Guidance.

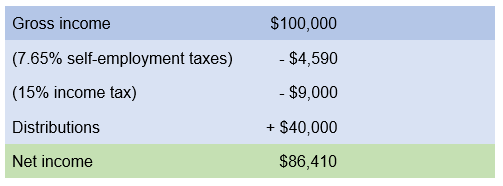

For instance in fiscal 2014 Google reported an income tax expense of 3331 million on 17259 million in pre-tax earnings. The calculated Tax Rate represents the combined Federal and Provincial Tax Rate. Your business earns 100k in revenue and has 50k in business expenses thats a 50k profit on your form Schedule C.

This tax is also known as the FICA Medicare or social security tax and is. If your business has net income of 70000 and youre taxed as an LLC you will owe nearly 10000 in self-employment tax. Youre guaranteed only one deduction here effectively making your Self.

S corporations are corporations that elect to pass corporate income losses deductions and credits through to their shareholders for federal tax purposes. Check each option youd like to calculate for. Annual cost of administering a payroll.

Use this calculator to get started and uncover the tax savings youll. Electing S corp status allows LLC owners to be taxed as employees of the business. If you are self-employed you have to pay both the employer and employee portion which was 153 in 2016.

We Simplify The Process And Keep It Industry-Specific So You Can File Taxes w Confidence. Updated for the new lower rates announced in the 2011 Budget - 26 Main Rate and 20 Small Profits Rate. Well Search Thousands Of Professionals To Find the One For Your Desired Need.

S-Corp or LLC making 2553 election. Protect Your Business From Liabilities. We are not the biggest.

Lets look at some numbers to see how this works. The SE tax rate for business owners is. Small Business Tax Rates For 2020 S Corp C Corp Llc Just enter the five-digit.

However if you elect to. When you enter the street address the calculator uses geolocation to pinpoint the exact tax jurisdiction. Being Taxed as an S-Corp Versus LLC.

S Corp Tax Calculator - S Corp vs LLC Savings. This allows owners to pay less in self. As of the 1st of April in 2015 Corporation Tax has risen to 20 although in July of 2015 the Chancellor announced that based on budgets the rate of Corporation Tax will.

From the authors of Limited Liability Companies for Dummies. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. 43 rows To request forms please email formsdranhgov or call the Forms Line at 603 230.

This calculator helps you estimate your potential savings. S corporations continue to be the most prevalent type of corporation. Social Security and Medicare.

Start Using MyCorporations S Corporation Tax Savings Calculator. There is an extra 118 percent marginal tax rate caused by Pease limitations. Instead you only pay payroll taxes on the salary you earn from your S corp.

The calculator initially shows placeholder values so you know how the input values should look but you want to replace my. S corporation owners are required to pay federal income taxes state taxes and local income tax.

S Corp Income Tax Rate What Is The S Corp Tax Rate

Demystifying Irc Section 965 Math The Cpa Journal

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

S Corp Tax Calculator Tax Consulting Tax Preparation Services Savings Calculator

S Corp Income Tax Rate What Is The S Corp Tax Rate

S Corp Guide What Is An S Corporation Subchapter S

Llc Tax Calculator Definitive Small Business Tax Estimator

The Basics Of S Corporation Stock Basis

S Corp Vs Llc Everything You Need To Know

![]()

S Corp Vs C Corp Which Is Best Excel Capital Management

S Corp Guide What Is An S Corporation Subchapter S

Strategies For Minimizing Estimated Tax Payments

Llc Tax Calculator Definitive Small Business Tax Estimator

Corporate Tax Meaning Calculation Examples Planning

S Corp Payroll Taxes Requirements How To Calculate More